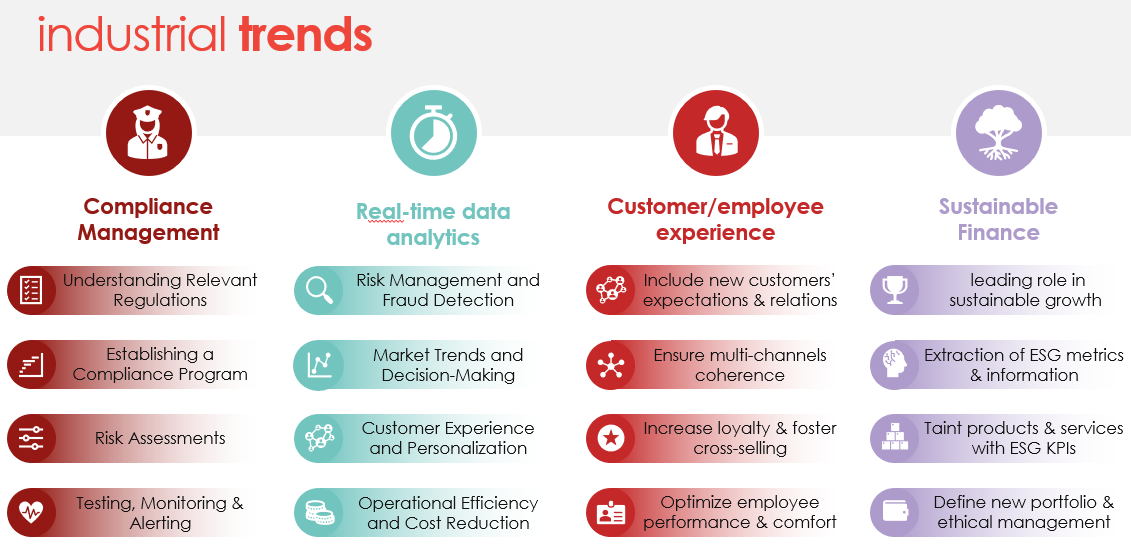

Increasingly rigid compliance

With new rules for (cyber)security and privacy (NIS2, DORA, …), ESG reporting, AI, and many more, the regulatory burden on financial institutions is skyrocketing. On top of that, legislation varies across regions, countries, and continents. Adhering to all the rules, laws and guidelines requires significant insights, effort, and resources.